The German social accident insurance provider for non-state institutions within the health and welfare service sectors (BGW) BGW - Berufsgenossenschaft für Gesundheitsdienst und Wohlfahrtspflege

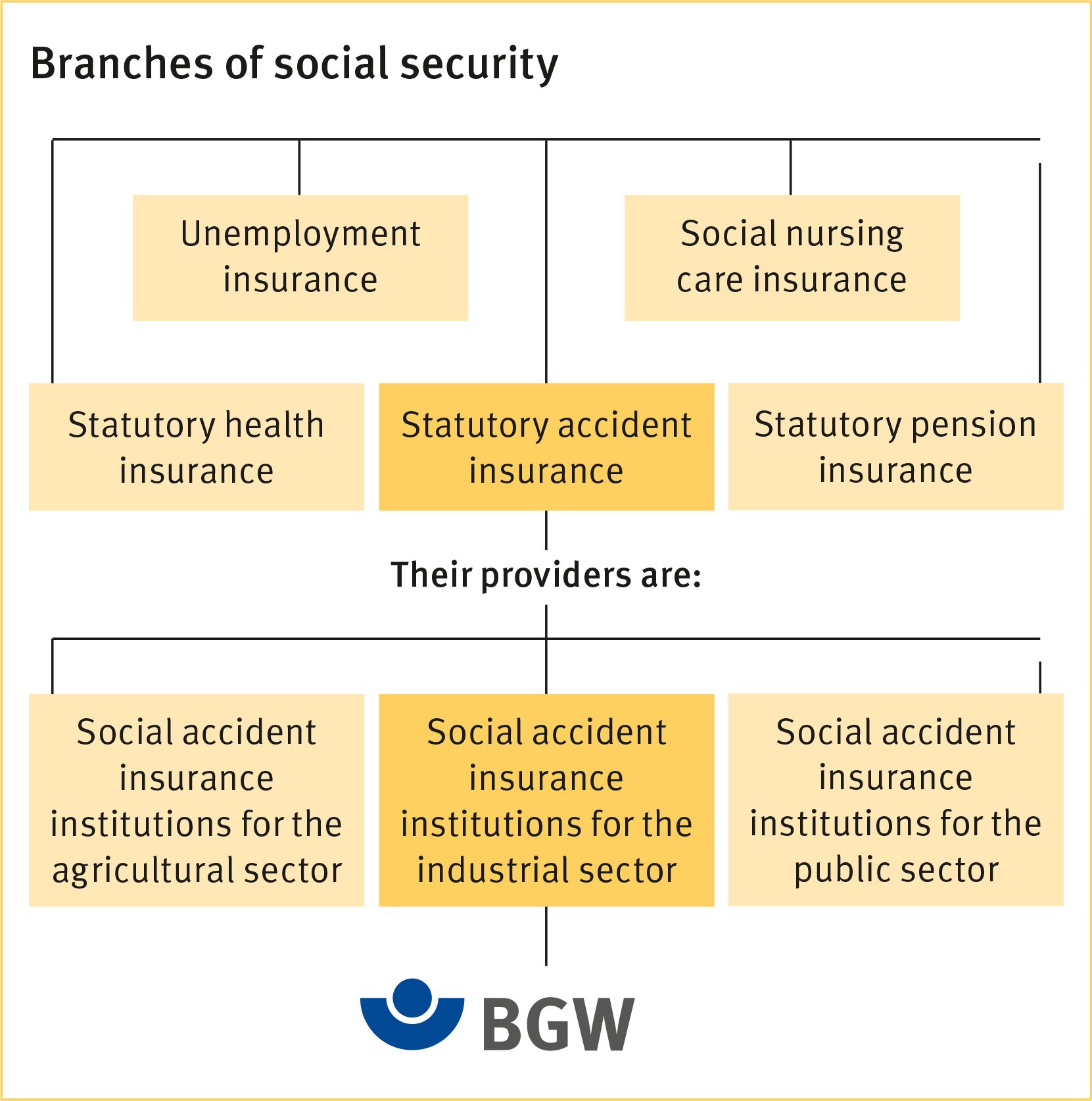

As part of the German social security system, the BGW is a public corporation that carries out on its own responsibility but under state supervision the tasks transferred to it by law.

The BGW is represented in twelve different locations throughout the country and has its headquarters in Hamburg. The BGW’s system of self-governance oversees and controls its administrative affairs.

The most important organs in this respect are the representatives’ assembly and the executive board, both of which contain equal numbers of representatives of employers and insured persons. The Chief Executive Officer is responsible for the day-to-day running of the BGW.

Active insurance cover

Prevention of workplace accidents, occupational diseases and work-related health risks is the main task of the BGW. In the event of a claim, the BGW guarantees optimum medical treatment and appropriate compensation and ensures that insured persons are able to return to professional and social life.

Companies paying obligatory premiums include welfare associations, independent public and private hospitals, medical, veterinary, dental and therapeutic practices, homes for the elderly, pharmacies, mobile care services, midwives and obstetricians, hairdressing and beauty salons and pedagogical establishments.

Insurance covers all employees and employers who are subject to compulsory insurance. All those not subject to compulsory insurance can arrange voluntary insurance cover on favourable conditions. Insurance also covers those working on a voluntary and unpaid basis.

Low-cost premiums – no profit

Statutory social accident insurance represents a form of liability cover for employers against the risk of employees suffering workplace accidents and occupational diseases. That is why it is only the employer who pays the premium for German social accident insurance cover.

As in the case of other social insurance schemes, the level of premium depends on the income of the insured persons. In addition, the accident risk in each occupation also plays a role, and this is expressed by allocation of each occupation to a risk category. The basis for calculating the premium is set by the BGW according to the financial requirements of a particular year.

The BGW is a non-profit organisation – only actual costs are passed on. Thus calculation of premiums always occurs retrospectively for the previous calendar year.

Comprehensive benefits

Prevention

The central task of the BGW is to prevent workplace accidents, occupational diseases and other work-related health risks. As nowadays some 90 percent of workplace accidents have behaviour-related rather than technical causes, it is people who are the central focus of holistic prevention work. This includes provision of advice and supervision of companies in relation to all safety and health issues, investigation of the causes of accidents and diseases, drafting of rules and regulations as well as active public relations work, provision of training in aspects of work safety, and also measuring of harmful workplace emissions.

Rehabilitation

BGW takes all the necessary steps to reintegrate injured or ill persons into working life, for example providing medical treatment, work-related measures such as retraining, initial and further training and also social measures such as modifications to the home.

Rehabilitation management

The main focus of rehabilitation management is on providing personal advice and support for insured persons and begins during the first phase of medical care. Everyone involved works together – the insured person, doctors, employers and rehabilitation professionals. This enables the rehabilitation process and the return to work to be coordinated from a single source.

Costs covered in the event of claims

In the event of a claim, the BGW covers the costs of therapy, occupational support, home-based or institutional care, loss of earnings during rehabilitation and pensions for the insured person and his/her surviving dependants. Where an individual is forced to change occupation, the cost of retraining/further training is covered. In the case of permanent disability, the BGW covers the cost of modifications to the home and the motor vehicle.

Competent advice

The BGW

- offers advice on workplace safety, information about statutory regulations and practical tips for ensuring a healthy workplace

- investigates the causes of workplace accidents, occupational diseases and work-related health risks

- develops and implements measures to prevent these

- offers a varied programme of education and training on accident insurance, prevention and health protection at its academies in Hamburg and Dresden

- ensures a locally-based service and rapid availability through its decentralised structure, with twelve locations throughout Germany

- offers occupational support in the case of accident or sickness aimed at enabling the insured person to return to work on a permanent basis

- engages in dialogue with insured persons and companies at exhibitions and other events

- offers comprehensive information and support materials related to occupational health and safety on social networks and at www.bgw-online.de – most of them with barrier-free accessibility. Also: media, forms and digital services.

- offers a free media app which allows mobile access to the magazines for companies, employees and trainees.

Detailed information about the development of the BGW and the insurance claims it has processed, together with reports on the main focus of its preventive work, can be found in the BGW Annual Report: www.bgw-online.de/jahresinfo